Petrochemicals & Natural Gas: Supplying the Global Marketplace

Low-cost feedstock for international li-ion battery and solar panel manufacturing demands.

Alberta is home to Canada’s largest refining and petrochemical manufacturing industry and produces more than 60% of the country’s natural gas. Competitive advantages include abundant, low-cost feedstocks (including alternative fuels, synfuels, and bio-based, renewable feedstocks), an extensive transportation network, and a $10 billion infrastructure enhancement program.

Alberta’s infrastructure has positioned Canada as having the #1 ranking global lithium battery supply chain in the world according to BloombergNEF’s (BNEF’s) Global Lithium-Ion Battery Supply Chain Ranking. Additionally, Canada is the 4th largest natural gas producer globally due to Alberta’s contributions on the Western Canadian Sedimentary Basin. The competitive pricing of the abundant natural gas supply appeals to businesses and investors around the world seeking reliable energy resources and cost-effective petrochemical feedstocks. Alberta’s commitment to ESG goals and innovating CCUS technologies, offers pathways to produce eco-friendly petrochemicals and fuels necessary to meet the growing global lithium-ion battery, solar panel, and EV manufacturing demand.

Alberta Stories

Inter Pipeline

4TH LARGEST NATURAL GAS PRODUCER IN THE WORLD: LOW-COST FEEDSTOCK

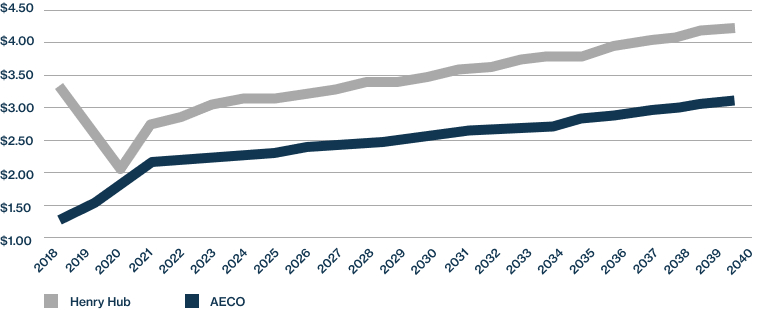

Canada ranks as the 4th largest natural gas producer in the world, with Alberta sourcing 70% of its natural gas from the heart of the Western Canada Sedimentary Basin. Alberta’s natural gas often trades at a discount compared to U.S. sources, making it a leading supplier of affordable petrochemical feedstock in North America.

Alberta leads in propane production, with 88% of Canada’s propane, derived from natural gas, produced within the province. This efficiency in natural gas utilization supports a diverse energy supply, strengthening Alberta’s international energy export market presence.

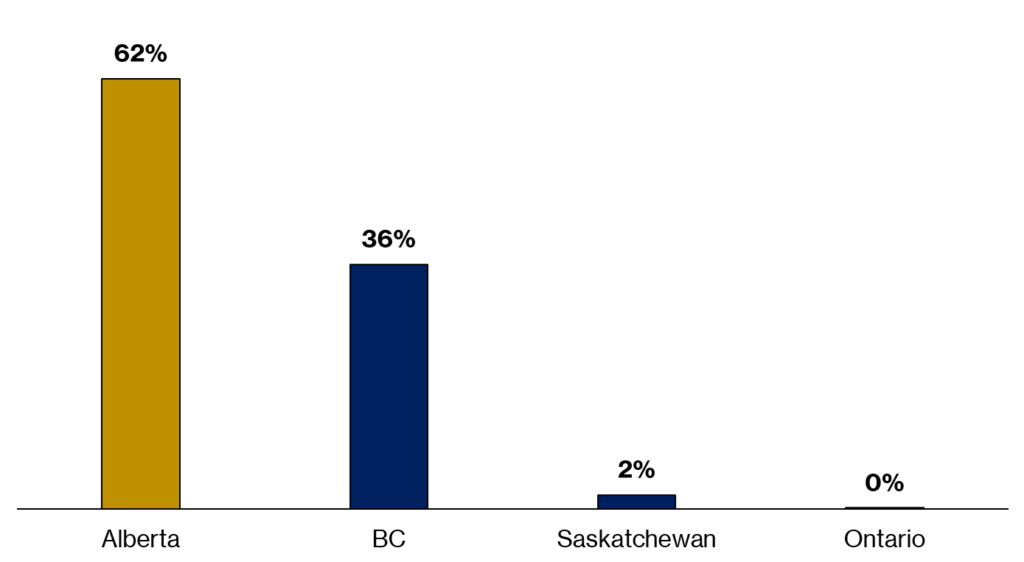

Share of Natural Gas Production by Province

Natural Gas Price Forecast

Alberta produces over 60% of Canadian natural gas

ETHANE & ETHYLENE PRODUCTION CAPACITY

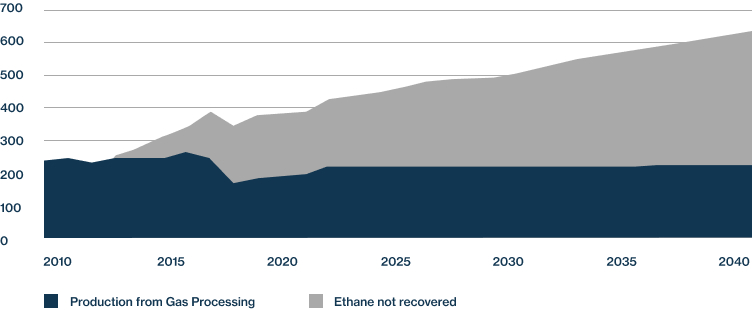

Alberta is a significant supplier of ethane as a petrochemical feedstock to manufacture plastics and other industrial and consumer materials. Alberta’s four ethane-cracking plants have a capacity of 4.1 million tonnes per year accounting for almost 80% of Canada’s total installed ethylene-producing capacity.

The production of ethylene in Alberta is a critical component of the petrochemical industry, utilizing advanced steam cracking technology to convert ethane content and other natural gas liquids into ethylene. The competitive cost of ethane prices in Alberta, coupled with its efficient transportation system, ensure a steady and reliable supply of ethane for ethylene production.

Canada’s Ethane Production Potential

PETROCHEMICALS FOR LITHIUM BATTERY, SOLAR PANEL, AND EV MANUFACTURING WORLDWIDE

Canada ranks as having the #1 global lithium battery supply chain in the world according to BloombergNEF’s Global Lithium-Ion Battery Supply Chain Ranking. The ranking is based on 46 specific measures divided into five main categories: availability of raw materials, battery production capabilities, market demand, ESG, and overall industry, infrastructure, and innovation. Alberta’s well-developed infrastructure abundant natural gas resources supply the raw material for petrochemicals used in manufacturing components for many emerging technologies. This includes the casings of li-ion batteries and the plastics and polymers that form the frames of solar panels.

The global lithium-ion battery market expected demands in the international market surpasses $120.65B by 2028. The production of lithium-ion batteries, which power EVs and store renewable energy, heavily depends on petrochemical-derived components. Moreover, petrochemical-derived materials facilitate the development of lightweight parts for electric vehicles, improving their efficiency, driving range, and environmental sustainability.

Solar PV manufacturing demand leads the renewable sector worldwide, with market demand set to more than double by 2028, compared to 2022.

$7.2 billion in petrochemical projects are planned, underway or have recently been completed in Alberta

ALTERNATIVE & SYNTHETIC FUELS: LOW-CARBON SOLUTIONS

Alberta is actively exploring the development and implementation of alternative fuels and renewable fuels, such as bio-biased diesel fuel to reduce greenhouse gas emissions and diminish the carbon footprint of the transportation sector.

Through Alberta’s leadership in the global energy transition, The Municipal District of Greenview, Alberta, has joined with Interprovincial Fuel Solutions Ltd, developing a facility focused on synthetic fuel production, along with hydrogen production.

This $600 million project is set to manufacture synthetic fuels, serving as an alternative fuel source capable of producing over 5,600 barrels per day of low-carbon gasoline from natural gas, water, and oxygen. Aimed at reducing greenhouse gas emissions, this initiative utilizes carbon capture technology to sequester 250,000 tonnes of carbon dioxide annually, significantly lowering the carbon footprint associated with traditional liquid fuels and internal combustion engines.

PETROCHEMICAL INDUSTRY BUSINESS OPPORTUNITIES AND INTERNATIONAL EXPORT

Alberta has one of the largest natural gas infrastructure networks in North America. TC Energy’s Nova Gas Transmission Line (NGTL) is the primary gas delivery system in Alberta — connecting the Western Canadian Sedimentary Basin to domestic and export markets through 33,000 km of pipeline. The company is currently implementing a $10 billion infrastructure program to add 3.5Bcf/d of incremental delivery capacity by 2024 which will expand the capacity of the network to deliver natural gas throughout Alberta.

Alberta is also home to the largest petrochemical manufacturing centre in Canada. Alberta’s Industrial Heartland counts 40 industrial sites, 7,000 employees, and $40 billion in investment. $7.2 billion in petrochemical projects are planned, underway or have recently been completed in Alberta. Alberta’s extensive rail network allows market access across North American and Asian markets for supply chain deliveries. The Port of Vancouver and Port of Prince Rupert, two of Canada’s largest ports, offer trade departures to major Asian markets including China, Japan, South Korea and India.

GROWING THE GLOBAL FUTURE OF PETROCHEMICAL INDUSTRY MARKETS

Alberta’s midstream natural gas infrastructure has the capacity to accommodate new petrochemical projects. Through the province’s Natural Gas Vision and Strategy, Alberta plans to increase processing and transportation capabilities to become a global top 10 producer of petrochemical products.

According to the Alberta’s Industrial Heartland Association, there’s an opportunity to grow Alberta’s petrochemical sector by more than $30 billion by 2030.

INTERNATIONALLY BUSINESS-FRIENDLY POLICIES AND GOVERNMENT INCENTIVES

Alberta’s government supports the long-term growth of the petrochemical industry by creating the best possible policy environment through cutting red tape and facilitating approvals. Government incentive programs, such as the Alberta Petrochemical Incentive Program (APIP), make Alberta an attractive place to build new petrochemical plants.

Alberta is one of the most cost-effective jurisdictions in North America, with the lowest corporate income tax in Canada.

ACCESS TO PETROLEUM ENGINEERING & CHEMICAL INDUSTRY EXPERTS

Alberta has a well-established petrochemical industry, with 36 chemical and petrochemical manufacturers operating throughout the province. It’s home to the most engineers per capita in Canada with a large labour pool specializing in petroleum and chemical engineering. Research and development costs in Canada are very cost effective, as salaries for highly skilled labour are lower than in other industrialized countries.

The Government of Alberta and Invest Alberta offer a regulatory roadmap and supports to help navigate investments into the sector. Alberta’s Department of Energy and Department of Environment and Parks also have in-house expertise to ensure accurate assessment of projects.

The global hydrogen industry could be worth $2.5 to $11 trillion USD annually by 2050

Alberta Stories

Edmonton Region Hydrogen Futures

Alberta is working hard to create a sustainable, low carbon future for the world through environmental stewardship, positive social change and global governance leadership

areas of focus

Cleantech

-

CO2 capture, aggregation and sequestration

-

Hydrogen transfer, hydrogen fuel cells and hydrogen production

-

Blue methanol production

Alberta is leveraging its expertise in cleantech and leadership in carbon capture and CCUS to produce new low-carbon petrochemical products.

Abundant Natural Gas and Feedstock

-

Natural gas and natural gas liquids fractionation

-

Propylene and polypropylene

-

Ethylene and polyethylene

-

Methane and methanol

-

Ethanol amines

Alberta’s abundant supplies of natural gas provide petrochemical plants with low-cost feedstocks to develop a range of products.

Infrastructure

-

World-class value-added processing

-

Extensive natural gas delivery system

-

Propylene derivatives plants

-

Ethane cracking complexes

Alberta has modern, world-scale plants and the largest natural gas infrastructure networks in North America.

Access to Markets

-

CP and CN: transcontinental rail carriers with intermodal terminals

-

Rail access to Canada’s two largest ports

Alberta’s efficient transportation systems allow access across North American and Asian markets.

Tax advantage

Alberta’s competitive advantage comes from low tax rates, lucrative incentives and business-friendly policies

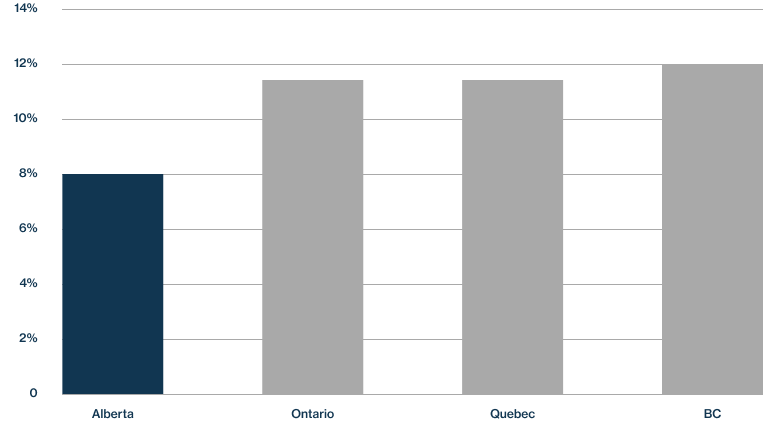

Lowest Corporate Tax Rates in the Country

Alberta’s corporate tax rate is 8% — the lowest in the country and competitive across North America.

Alberta Petrochemicals Incentive Program

Provides grants worth up to 12% of eligible capital costs once operational.

Stable Fiscal and Regulatory Environment

Canada scores in the top 20 of the World Bank’s Political Stability Index.

Lowest Tax Rate in Canada

ESG

Alberta is a leader in environmental protection — implementing policies that enable industrial sectors to reduce emissions while making investments in innovative technologies

Carbon Capture and Storage

Home to the world’s first commercial-scale oil sands CCUS facility.

Sustainable by Design

NWR Sturgeon Refinery is the world’s only refinery designed from the ground up to minimize its environmental footprint.

A Pioneer in Blue Methanol

Nauticol is the first company to produce net-zero blue methanol at a world scale.

Major Carbon Capture Potential

Alberta Carbon Trunk Line is the world’s largest CO2 pipeline — sequestering 14.6 million tonnes of CO2 per year.

Leader in Low-Carbon Hydrogen

World’s largest net-zero hydrogen energy complex being built in Alberta’s Industrial Heartland.

Emissions Reduction

$449M in stimulus funding over four years through Tech Innovation Emissions Reduction (TIER) program to reduce emissions.

Talent and productivity

Alberta is home to a young, diverse and highly educated workforce, with expertise in the petrochemicals sector

Concentration of Engineers

Alberta is home to the most engineers per capita in Canada.

Post-Secondary Education Rates

The combined share of workers with a post-secondary certificate and university degree rose to 64.9% in 2020.

Globally Ranked Post-Secondaries

Alberta’s globally ranked post-secondary institutions produce experts in engineering, mining and petroleum production.