Lowest Canadian Corporate Tax Rate for International Businesses

Alberta has one of the lowest corporate tax rates in the world at a combined total of 23%, supporting the ideal globalized business environment.

Alberta, home to Canada’s most business-friendly cities, boasts the lowest corporate income tax rate in Canada and among the lowest in North America with no provincial sales tax, no payroll tax, and no health-care premiums. The province also invests more per capita than any other province. We’re a powerhouse – quite literally – as a global leader in energy production and industries ranging from energy transition, life sciences, agriculture to financial services and tech. Plus, we offer room to grow, with some of the most affordable Class A downtown office space in North America and ample and affordable land for development.

Alberta’s largest city Calgary has the largest concentration of company headquarters in all of Canada and is home to 7 of the top 10 world banks, while North America’s fastest-growing tech ecosystem is located in Edmonton. In between, our small towns and midsize cities support our diversifying economy. In Alberta, we invest in business success through a variety of programs, move quickly and creatively to solve challenges, and welcome business with open arms.

Alberta Legislature Building in Edmonton, Alberta

Photo Credit: © Travel Alberta Photo by Sameer Ahmed

Alberta’s tax advantage in 2025-26 is $20.1 billion. Albertans and Alberta businesses continue to pay the lowest overall taxes compared to other Canadian provinces.

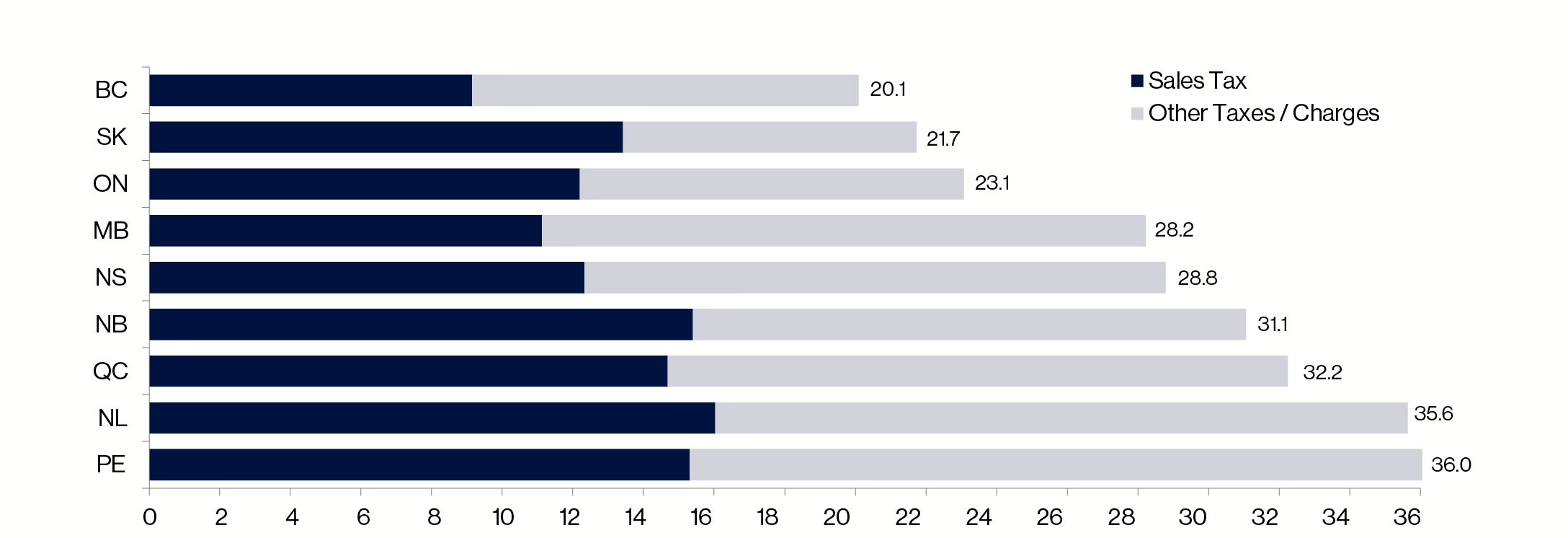

ALBERTA’S TAX ADVANTAGE: NO PROVINCIAL SALES TAX

Alberta’s tax advantage is an estimate of the total additional provincial taxes individuals and businesses would pay if Alberta had the same tax system as other provinces.

For individuals and cost of living, the flat personal income tax rate simplifies the taxation process, minimizes the taxable income burden, and makes Alberta an affordable international destination for professionals and entrepreneurs.

Alberta tax advantage in 2025-26 relative to other provincial tax systems (in billions)

Source: Alberta Treasury Board and Finance

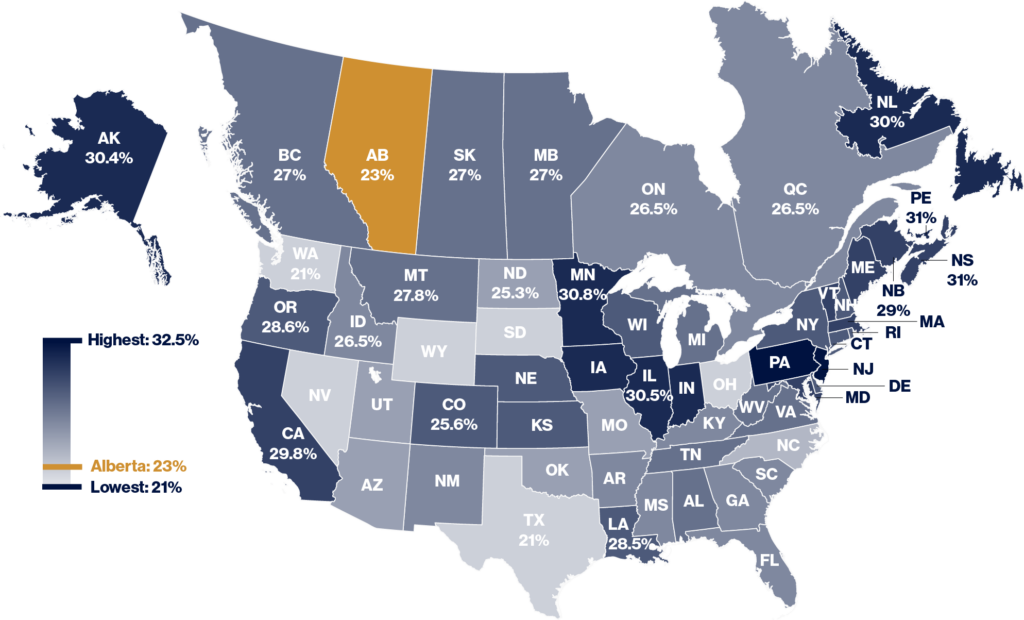

LOWEST CANADIAN CORPORATE INCOME TAX RATE

Alberta has the lowest corporate tax rates in Canada, with a provincial rate set at 8%, combined with the federal rate of 15%, establishes a total corporate income tax rate of 23%.

For small businesses, specifically those with active business income below $500,000, Alberta offers a reduced rate of 11% (9% federal and 2% provincial), signalling a support system for entrepreneurship and innovation. This strategic tax positioning attracts foreign company investments and also benefits Canadian-controlled private corporations (CCPCs) by optimizing their taxable income and facilitating sustainable growth.

Lowest corporate income tax rates in North America

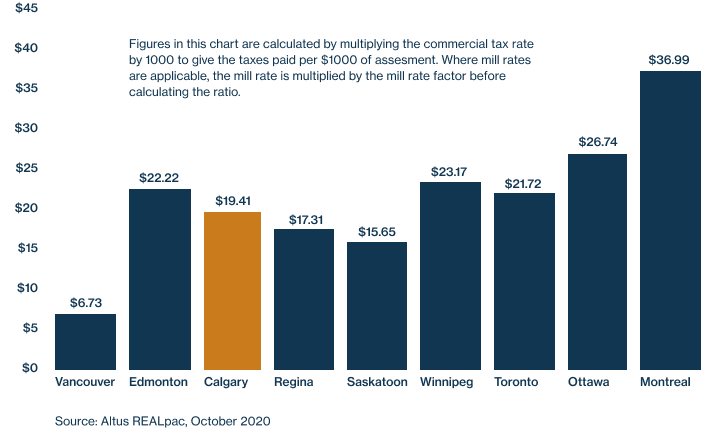

LOW NORTH AMERICAN COMMERCIAL PROPERTY TAX RATES

Edmonton and Calgary are distinguished by their competitive commercial property tax rates within Canada, particularly when benchmarked against other major cities. These municipalities offer both property tax exemptions and property tax relief incentives for up to 15 years, a policy aimed at attracting and retaining businesses.

The effective property tax rates in Calgary (2.1%) and Edmonton (2.6%) are structured to support commercial property owners, contributing to Alberta’s reputation as a conducive environment for business operations. These cities offer some of the lowest property taxes in North America when compared to the average effective property tax rates in American states in US (2024) such as California (1.99%), New York (1.5%), Texas (1.92%), and Rhode Island (3.45%), where commercial properties often face higher real estate taxes.

Estimated commercial property taxes in Calgary relative to other Canadian provinces (per $1,000 of assessment)

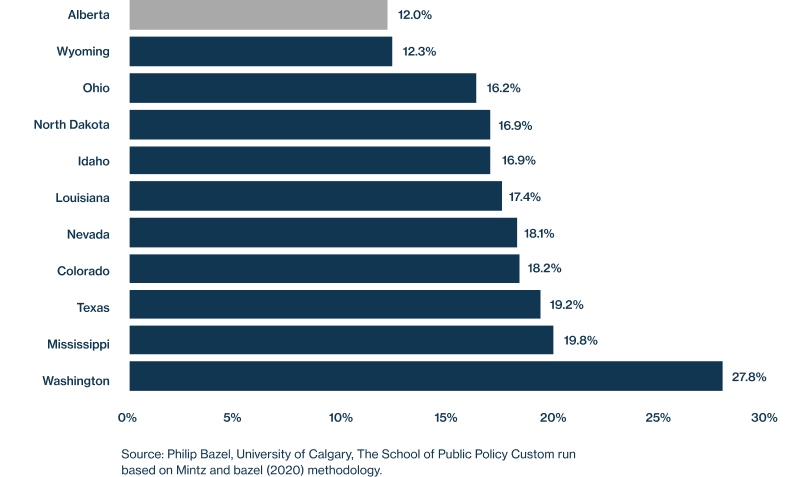

ALBERTA, CANADA TAXES VS US STATES: CORPORATE MARGINAL EFFECTIVE TAX RATE COMPARISON

Alberta’s fiscal policies establish a competitive corporate tax environment compared to the USA, when evaluated through the lens of the Marginal Effective Tax Rate (METR). The province has a lower combined federal-provincial corporate income tax rate compared to the federal-state rates applicable in 44 U.S. jurisdictions.

In Alberta, the METR calculation incorporates both provincial and federal government taxes, alongside mechanisms to avoid double taxation, thereby optimizing the tax framework for active business income. This contrasts with the United States, where variations in federal tax rates, alongside the diversity of state-level corporate taxes and the complexity of federal income tax regulations, can elevate the METR, thereby impacting the marginal rate of return on new investments.

Corporate marginal effective tax rate of Edmonton, Canada vs US Taxes

Book a Meeting

Learn how we can help you maximize the speed, ease and costs of expanding or relocating your business to Alberta

Calgary Folk Festival and Bow River in Calgary

Photo Credit: © Travel Alberta Photo by Tourism Calgary